A Sendirian Berhad Sdn Bhd company in Malaysia is a private limited business entity which can be started by both locals and foreigners. This post is also available in.

Ics Soalan 2 Docx 2 Would The Business Be Open To An Audit Exercise Since It Is A Sdn Bhd All Sendirian Berhad Company Sdn Bhd Needed To Have Its Course Hero

Harga Pelupusan Dianggap Bersamaan Dengan Harga Pemerolehan Available in Malay Language Only.

. The companys lender requires an audit. The audit threshold for all charities is different from non-charitable entities. Report To Be Prepared For Exemption under Schedule C.

Public Holidays in Malaysia for 2022. If your qualification is on our database of accredited programmes you will see which CIMA exams you may be exempt from. Our exemptions search will help you find out if the qualification you have studied exempts you from sitting some CIMA exams.

Report To Be Prepared For Exemption under Schedule B. On 1 June 2018 GST was set at zero by the Malaysian government. Superceded by the Tax Audit Framework On Finance and Insurance 18112020 - Refer Year 2020.

It is advisable that all employers in Malaysia remain aware of the upcoming public holiday dates. UCSI is also the first seven universities in Malaysia to collaborate with the ACCA Accelerated Programme AAP with the exemption for 9 Foundation papers for their accounting and finance degree programme. When Facebook announced Echo and Biforst cables to provide redundant and reliable.

When you share your giving to UM you become part of our community that helps to enhance our students welfare provision and improve facilities to support their learning experience and research discoveries. More 119 22042019 NEWS 6. Kolej Universiti Poly-Tech MARA KUPTM Kolej Universiti Poly-Tech MARA KUPTM is one of the largest private higher institutions in the.

繁體中文 Chinese Traditional 简体中文 Chinese Simplified Audit Exemption and Reporting Exemption for Dormant Company in Hong Kong According to Hong Kong Law. More 120 18042019 FAQ on Digital Service Tax DST More 121 04042019 NEWS 5. Audit and Assurance AA Youll develop knowledge and understanding of the process of carrying out the assurance engagement and its application in the context of the professional regulatory framework.

The Royal Malaysian Customs Department RMCD administers this type of tax. It was replaced by a more robust and people-friendly tax collection system on 1 September 2018 which is referred to as the sales and service tax SST. To support future sale or public offering of the business.

According to Section 447 Cap. A grant provider requires an audit. The Prime Ministers Department in Malaysia has announced the dates of the upcoming public holidays in Malaysia.

Visit the Website of the Fisheries Academy Malaysia Department of Fisheries Malaysia for information on training and fisheries certificate programmes. All businesses in Malaysia are required to be registered with the Companies Commission of Malaysia SSM. Marine Park Fee Exemption.

Application For Exemption Under Schedule C Item 3 or 4 Alert for old Certificate Alert for old. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai. The company constitution may require it.

Directors or shareholders may request an audit assurance. Universiti Terbuka Malaysia UNITEM Open University of. To encourage Malaysian resident individuals to rent out residential homes at reasonable charges Malaysia budget 2018 announced that 50 income tax exemption be given on rental income received by Malaysian resident individuals in year of assessment 2018 subject to the following conditions.

When did Malaysia get SST. Quoting a study by Analysys Mason on the impact of Googles APAC network infrastructure between 2010 and 2019 it found that network investments led to an extra US340 billion about RM14 trillion in aggregated GDP and 11 million additional jobs in the APAC region. Is SST claimable Malaysia.

The SSM is the governing. Russia since mid-June has drastically cut flows to Europe via the Nord Stream 1 pipeline and currently supplies just 20 of agreed volumes blaming faulty and delayed equipment while Europe says. This ensures the better management of manpower and smooth operational transitions.

Tax Exemption On Rental Income From Residential Houses. 622 of the Hong Kong Companies Ordinance the Ordinance a private company in Hong Kong can declare as a dormant company by passing a. Kursus Audit Dalaman MS ISO 90012015 pada 21-22 Julai 2022 bertempat di Taman Agrotekbologi MARDI Cameron.

Sendirian Berhad Sdn Bhd Company in Malaysia Business Owners Must Know.

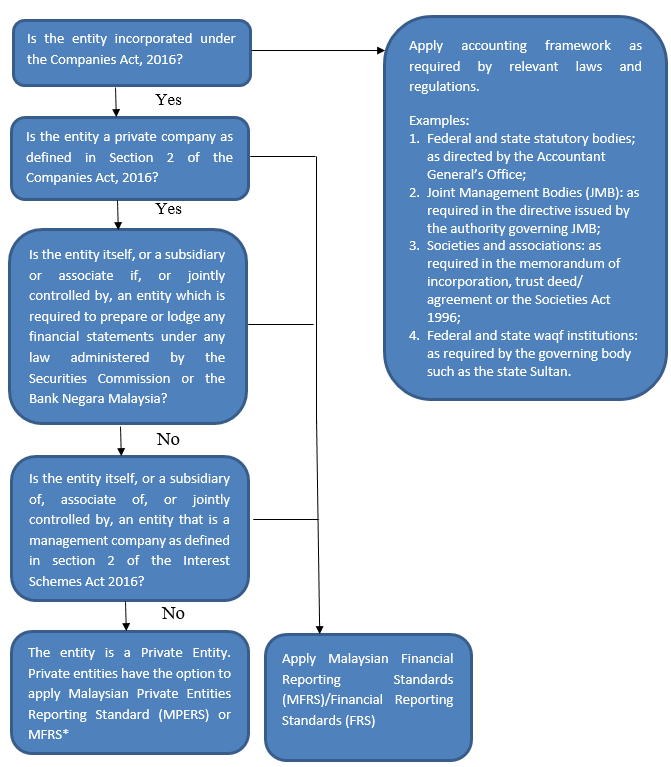

Accounting Standard L Co Chartered Accountants

Small Company Concept For Audit Exemption Premia Tnc

Ics Soalan 2 Docx 2 Would The Business Be Open To An Audit Exercise Since It Is A Sdn Bhd All Sendirian Berhad Company Sdn Bhd Needed To Have Its Course Hero

Malaysia Special Tax Concessions For Individuals Kpmg Global

You See Fsi Not A Real U Turn Synergy Tas

Pdf An Overview On The Basics Of Islamic Audit

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Ics Soalan 2 Docx 2 Would The Business Be Open To An Audit Exercise Since It Is A Sdn Bhd All Sendirian Berhad Company Sdn Bhd Needed To Have Its Course Hero

Audit Requirements For Private Companies

Cosec Fareez Shah And Partners

Dormant Company Filing Requirement Corporate Compliance

Tax Identification Number Tin L Co Accountants

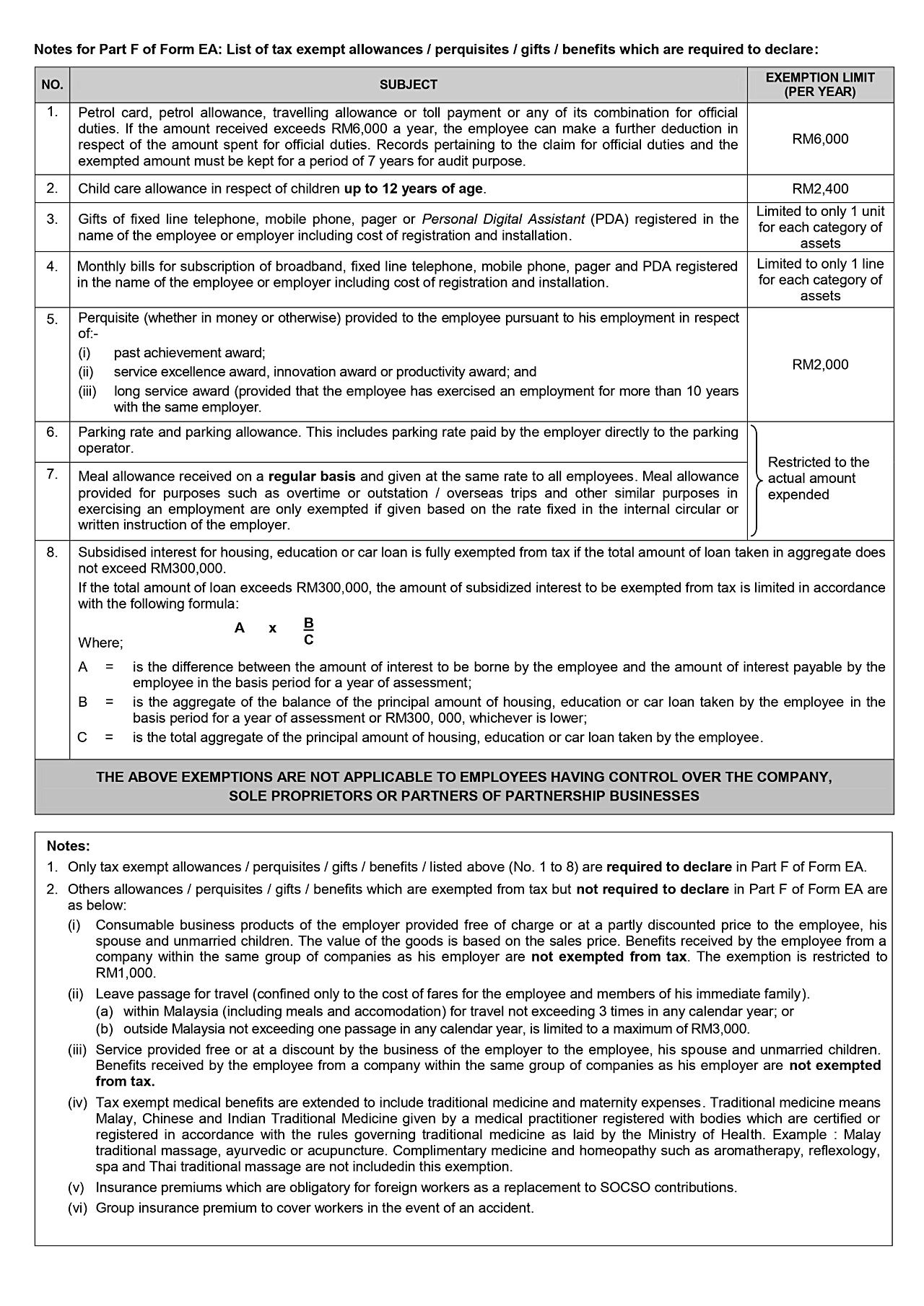

Allowance Guide In Malaysia 2021 Summary Of Lhdn Tax Ruling Seekers

Vol 5 No 1 2012 Asian Journal Of Accounting Perspectives

Ics Soalan 2 Docx 2 Would The Business Be Open To An Audit Exercise Since It Is A Sdn Bhd All Sendirian Berhad Company Sdn Bhd Needed To Have Its Course Hero

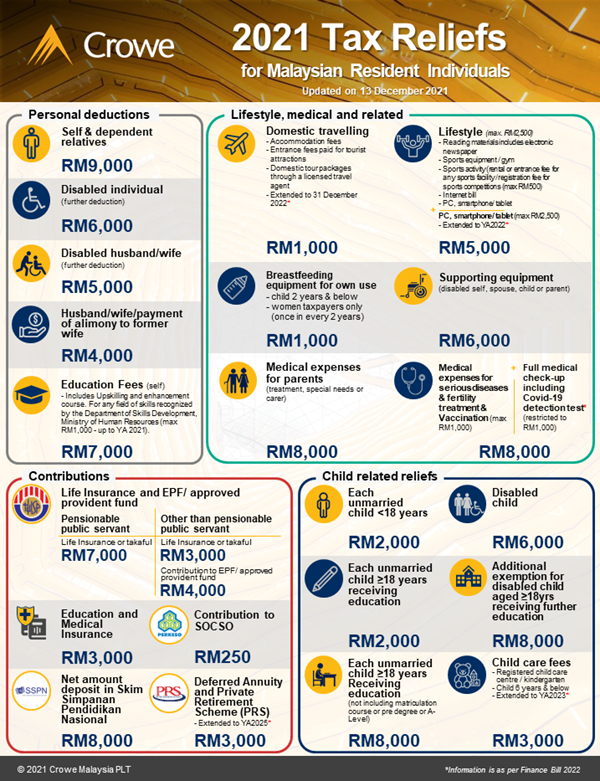

Infographic Of 2021 Tax Reliefs For Malaysian Resident Individuals Crowe Malaysia Plt

J K Tan Co Johor Bahru Audit Firm Approved Company Auditor Licensed Tax Agent Sst Sst Seminar Gst Tax Agent Accounting Johor Bahru Chartered Accountants Johor